Welcome Aboard on the journey of Stock Markets.

Ladies and gentlemen, welcome onboard flight- Basics of Stock Markets with service from level newbie investor to a smart investor. Please fasten your seatbelts and keep your devices, notebook, and pen handy. Tips/calls are prohibited for the duration of the flight. Thank you for choosing team CARR. Happy learning!

You might be wondering that why is ma’am making this announcement. Well, learning about the stock market is no less than a flight. When you start learning about the stock market, you take off in the market, you might even face some turbulence during the journey and ultimately you land well only if you have learned the secrets to successful and efficient investing. If you wish to board on this fun flight you have arrived at the right airport, my friend. We will make sure that you understand all the concepts, right from the basic to the advanced level in the stock market, in the most simplified manner.

Are you ready? Let’s get started!

Why should one invest in the Stock Market?

Because I said so? Absolutely no! We all have dreams and aspirations in our lives which we are passionate about. For some people, it might be getting a nice car, for some, it might be going on a fancy vacation or some might wish to build their dream home. Irrespective of what the dreams are, they become achievable when the finances are in the right place. So, let’s understand how investing in the stock market can help us in our financial life.

1. Start with a small amount :

Believe me or not, but investing in the market could cost as low as a pizza! Yes, you read that correctly. On average, we spend between Rs. 500 - 1000 on pizza. There are several quality stocks within this price range to invest in. We can even invest with a minimum of Rs. 500 regularly in stocks or mutual funds. This proves that investing in the stock market doesn’t burn a hole in the pocket. Just imagine how well your wealth and health can improve only by redirecting your pizza money into the market.

2. Enjoy the magical power of compounding :

We all have learned about compound interest in our schools. What we did not know then was how it is rightly called the 8th wonder of the world. It is simply a way of earning more interest on the already earned interest. Let’s understand this with an example. Let’s say you invest Rs. 1000 every month for 25 years expecting 10% return p.a. Your total investment amount of Rs. 3 Lacs would have grown to approximately Rs. 13 Lacs. And that, my friend, is the power of compounding!

It’s like your money is earning more money for you, isn’t it? The compounding effect would be more if you stay invested for a longer period. Hence, it is correctly said that “Time is money” and one must start investing as early as possible.

3. Victory over inflation:

Inflation is like a hanging sword over our necks. It is reducing the purchasing power of our money. As per the trading economics, the average rate of inflation between 2012 to 2021 was around 6.01 percent in India. The bad news is that inflation is here to stay and we can’t do much about it. The good news is that the stock markets can help us generate inflation-beating returns of around 10-12% if invested efficiently.

This is possible because India is a developing country. Hence, our industries grow in tandem with our economic growth and have the potential to reflect and generate returns by outperforming the inflation rate.

4. Higher returns than traditional investment avenues:

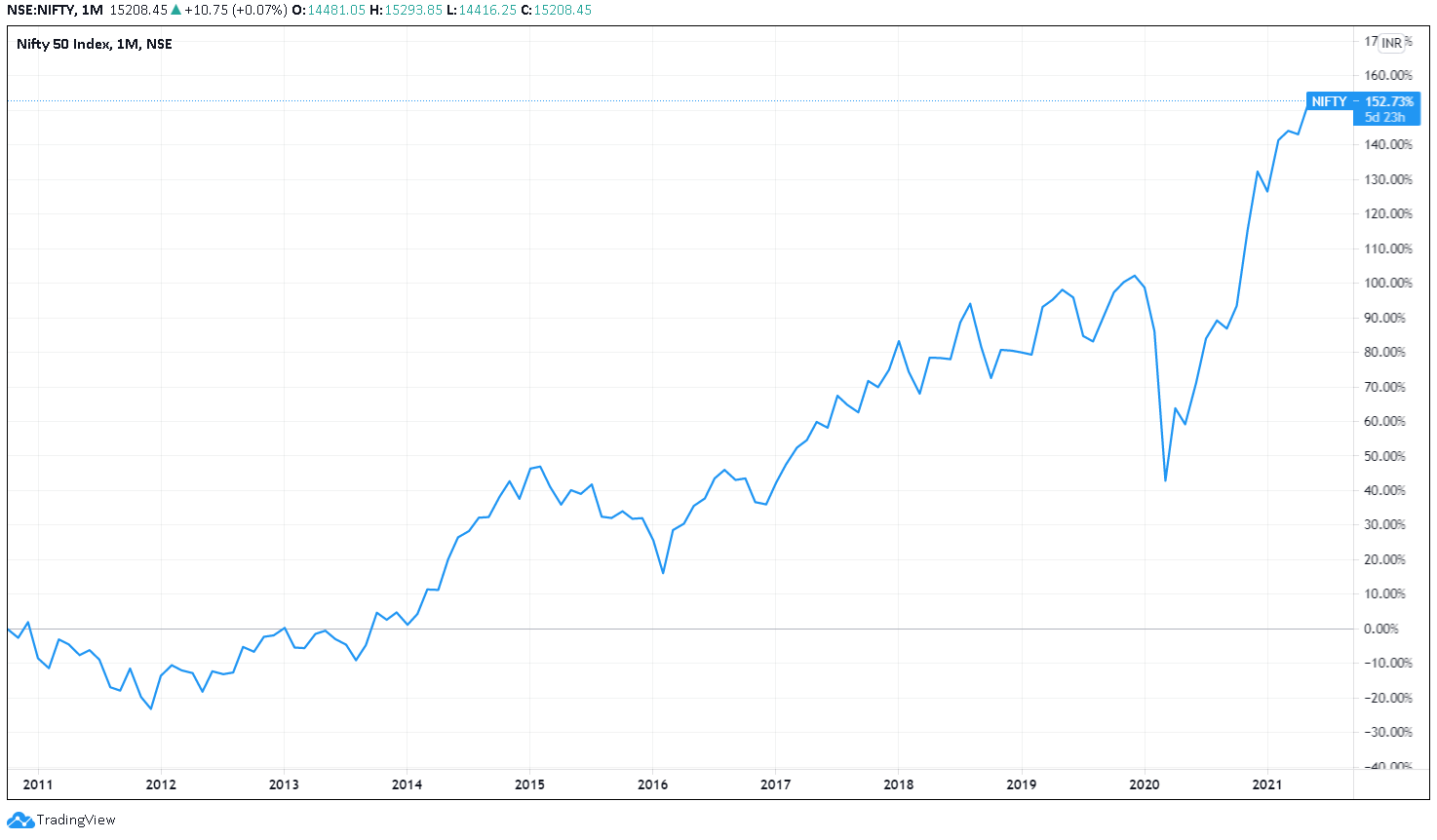

FDs have been a popular choice for investment amongst Gen X (born before the 1980s) and Gen Y (Born between 1980-95). They are considered to be a safe and secure option. Currently, FD rates range between ~4.50% to 6.00% percent for tenures between 1 and 10 years. Now, have a look at the Nifty chart below. The Nifty50 index has grown ~150% in the last 10 years! I agree stocks can be volatile however, the risk gets averaged out over a longer investment term. Investing in sound and proven companies can help you generate stable and better returns than FDs

5. Additional income source:

It is always wise to have more than one source of income. If at all you face any difficulties in your professional or personal life and are forced to discontinue your job then you might experience financial distress after a while. Hence, having an additional source of income comes in handy and the stock market can be of help in this case. You can earn through value appreciation and dividends from your investments providing steady income apart from your paycheck.

6. It is not rocket science:

You do not need any fancy degree or qualifications to understand investing in the market. No matter what your educational background or age is. If you approach it in the right way, you can perform the required analysis and research all by yourself.

Bottom Line:

There are several exciting concepts to learn like- the structure of the Indian financial market, what is Nifty, the basics of IPO, different types of corporate actions, Dividends, Stock splits, Block deals, and many more!.

Click the following image to know how to start learning about the stock market.