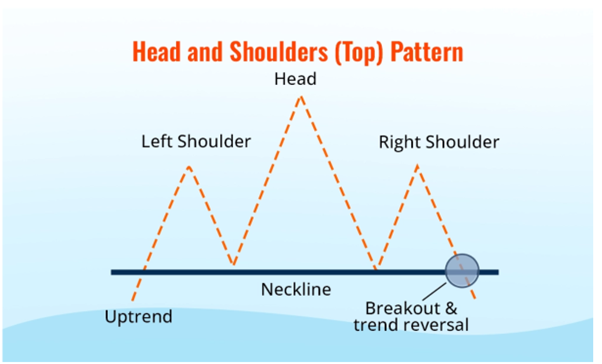

Learning chart patterns enable traders to anticipate potential trend reversals and structure their trades accordingly. One of the most reliable bearish reversal patterns is the Head and Shoulders. Identifying this formation early can help traders prepare for downward price movements and avoid long positions near potential market tops.

A Head and Shoulders is a bearish reversal pattern that resembles a peak (shoulder), followed by a higher peak (head), and then another lower peak (shoulder). It typically forms after a sustained uptrend, indicating that buying momentum is weakening and a bearish reversal could be on the horizon.

Anatomy of the Head and Shoulders Pattern

Left Shoulder: The pattern begins with a price rise followed by a temporary pullback. This forms the first (left) shoulder and signals initial resistance.

Head: The price then rallies to a new high, surpassing the previous peak, before pulling back again. This higher high forms the head of the pattern, often accompanied by lower volume.

Right Shoulder: A third rally occurs but fails to break the high of the head, forming a lower peak — the right shoulder. This reflects a loss of bullish momentum and increasing seller strength.

Neckline and Breakdown: The neckline is drawn by connecting the lows between the shoulders and the head. A breakdown occurs when the price closes below this neckline with rising volume, confirming the pattern and signalling a potential trend reversal from bullish to bearish.

How to Trade the Head and Shoulders Pattern

Entry Point

· Enter a short position when the price breaks and closes below the neckline with a noticeable increase in volume.

· Alternatively, wait for a retest of the neckline after the breakdown. Enter when the retest holds and the price starts to decline again.

· You may also split your position — for instance, 50% on the initial breakdown and 50% after a confirmed retest.

Target Price: Two common approaches to estimate downside targets:

Chart-Based Target:

· Measure the distance from the top of the head to the neckline.

· Subtract this distance from the neckline level to project the downside target.

· Target = Neckline – (Head – Neckline)

Fibonacci Retracement or Pivot Points:

· These tools help validate your target and highlight potential support zones during the decline.

Stop-Loss Placement

· Place the stop-loss just above the right shoulder to safeguard against failed breakdowns.

· If entering after a neckline retest, a tighter stop above the neckline is reasonable.

· Be cautious of overly tight stops in choppy markets to avoid premature exits.

Additional Tips

· Head and Shoulders patterns are most effective after a strong uptrend — in sideways markets, the reliability decreases.

· Volume generally declines from the left shoulder to the head and rises significantly on the breakdown below the neckline.

· Use confirmation from indicators such as RSI divergence (lower highs on RSI while price makes higher highs) or a bearish MACD crossover.

· A symmetrical and well-formed pattern with a clearly defined neckline increases the probability of success.

Charting Exercise: Switch to a daily chart and scan for potential Head and Shoulders formations. Clearly mark:

· Left Shoulder, Head, and Right Shoulder

· Neckline (support between the two troughs)

· Entry point (breakdown candle)

· Target and stop-loss levels

Use horizontal or trend lines to mark the neckline. Measure the vertical distance from the head to the neckline and project it downwards to estimate a conservative target. Confirm the breakdown with a spike in volume.

Homework: Study the following stocks and check if a Head and Shoulders pattern is forming or has recently completed:

1. Brigade Enterprises Ltd. (BRIGADE)

2. Nava Ltd. (NAVA)

You may also add the stock to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.