Cryptocurrencies like Bitcoin, Ethereum, Dogecoin, etc. are becoming familiar and popular amongst the global masses, every passing day. Famous personnel like Bill Gates, Elon Musk, Serena Williams, Snoop Dogg, Mike Tyson, and many more, are believers in Cryptocurrencies.

So, what is Cryptocurrency? what are its advantages and disadvantages? Is it legal? what is Blockchain? and finally, what is a bitcoin?...

My Goodness! So many questions. But don’t worry. I have the most simplified answers to all such mind-boggling questions. Stay tuned till the end of this blog to find out.What is Cryptocurrency?Let us break down this concept into two parts. The first is Cryptography and another is Currency. Currency needs no explanation so, let’s begin by understanding Cryptography with an example. You might have heard about Morse Code. It is nothing but a standard sequence of dots and dashes which was used by the military to communicate secretly during WW2. This ensured that only the receiver could decode the messages meant for them and not the enemy.Cryptography is somewhat similar to this practice. It uses complex mathematical codes to convert plain text into a coded series, which can only be decoded by the receiver of the message.Putting it all together, Cryptocurrency is a form of digital currency secured by cryptography. This ensures secure online payments through a decentralized network of a large number of mega-computers spread across the world. They are intangible and independent of any underlying.Special Features

- Decentralized

In simple terms, here Decentralize means free from any central authority. Cryptos work on a peer-to-peer network of computers, with an internet connection, across the world. You can trade in Crypto through centralized exchanges like WazirX. But there is no such central regulatory body (like SEBI, SEC, etc.), government or organization controlling these Cryptos as an instrument. Thus, making it free from political interference and influence. - Secure

Since cryptos are backed by a technology called the blockchain, there are very few chances of the system getting hacked. This makes it secure. Blockchain records every transaction and these records are openly available to the public. This further ensures its transparency. Now, how does this Blockchain work? It is discussed in the latter part of this blog.

- No intermediary required

If we were to transact the traditional way, we would need an intermediary like a bank, payment gateway, etc. to conduct an online transaction. However, as cryptocurrencies are decentralized, it has eliminated all such intermediaries. We can directly send cryptos to anyone, without a third party like our banks. - No geographical barriers

Cryptos can be transferred to anyone & anywhere across the globe. It goes beyond your banks’ national and international networks. - Swift

The crypto transaction can happen in as low as 4-5 seconds to a maximum of 10 minutes, depending upon the underlying technology being used by the currency.

Disadvantages of Cryptocurrencies

- Irreversible transaction

Just like we have a unique UPI ID for online transactions, cryptocurrencies have public and private keys. To transact, we need to input this key and the cryptos will be transferred to that key holder. However, if we make an error while entering this key, the cryptos will be transferred to the wrong key holder. Unfortunately, these transactions cannot be traced and you might lose your cryptocurrencies, as a refund is not an option. - Host of illegal activities

Cryptocurrencies are believed to be a host of illegal activities due to their anonymity feature. Some cryptocurrencies ensure anonymous transfers with no maximum amount limit which has encouraged money laundering and tax evasion activities in the world. In such cases, it becomes difficult for Governments to trace such fraudulent actions.

Is it Legal?

Well, Blockchain is the technology supporting the transfer of Cryptocurrencies. However, it also finds application in other industries like healthcare, logistics, e-commerce and many more. Blockchain is a global online database, which can be viewed by anyone, anywhere with a computer and an internet connection. In the case of Cryptos, it records the data of all the transactions taking place around the world. Due to this, it is also known to be a “Public Distributed ledger”. This database cannot be altered or hacked because it is visible and validated by the network users.

- How does it work?

As and when the transactions happen, it is being recorded in something called a “Block”. This block contains the transaction details like who is sending the crypto to whom, where, and how much they are sending. Each block has a unique code called Hash. It is created using complex cryptography algorithms, every time a block is formed. Once a block of transactions is complete, it will be linked to a new block. Thus, forming a chain of blocks on the network, which cannot be tampered with due to heavy encryption. All of this was made possible with the help of Blockchain technology.

The supply of bitcoin is limited to 21 million. As of March 2021, there were over 18.6 million bitcoins in circulation with a total market cap of around $927 billion. It holds more than 60% of the total value of all the cryptocurrencies of the world. As of April 17th, 2021, 1 bitcoin is worth Rs. 46,47,378.31!

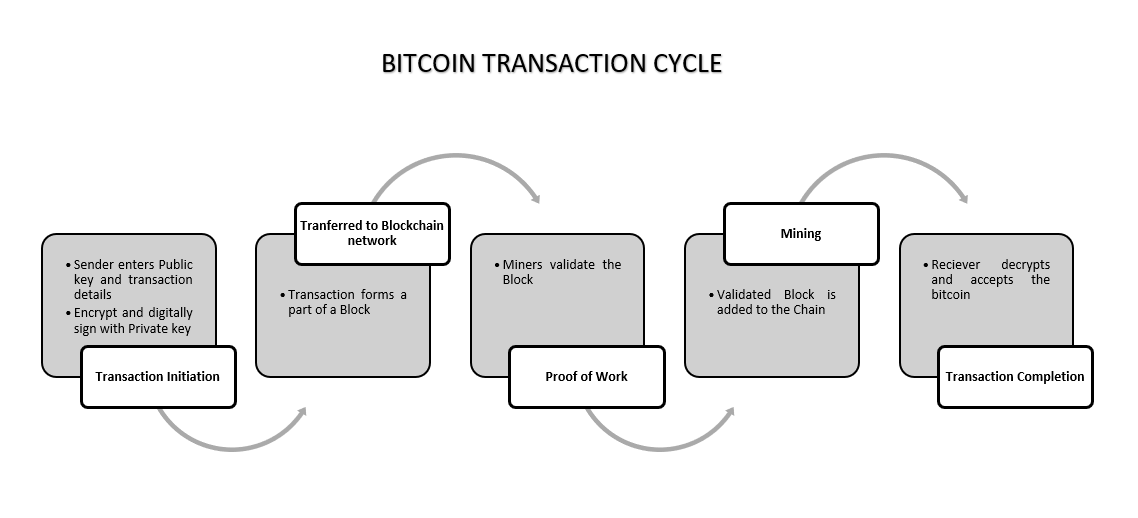

People usually use the terms Bitcoin and Blockchain interchangeably. But, that’s not the case. Bitcoin is a cryptocurrency backed by blockchain technology. Let’s move on to a little more advanced level and understand how a bitcoin transaction takes place on the network.

This transaction will become a part of a Block that needs to be validated before it is added to the Blockchain. This block will be validated by someone called Miners on the network. They solve a complex mathematical problem to validate a block and are in turn, rewarded with a few bitcoins. This process of validating a block is called ‘Proof of Work’ and the process of adding a block to the blockchain is called ‘mining’. On average, Bitcoin validation happens in 10 mins. Once validation is complete, all Mr. B gotta do is enter his private key to decrypt the transaction and receive his bitcoin.

Cryptocurrencies have evolved as a new option for portfolio diversification. There are so many options under the crypto umbrella to choose from. Some cryptocurrencies even offer fractional investment. Before investing in cryptos, one must note that it is not regulated and is technology-dependent. Even though few cryptos have proven themselves, if things go south, one might lose all of their crypto holdings.

I hope this blog has made understanding Cryptocurrencies a little easy for you. If you want to learn more about it stay tuned to my YouTube Channel, as I will be covering the “Basics of Cryptocurrency” in a series soon. Until next time!

MAKE SURE YOU ARE UNDERSTANDING ABOUT CRYPTOCURRENCIES BEFORE INVESTING