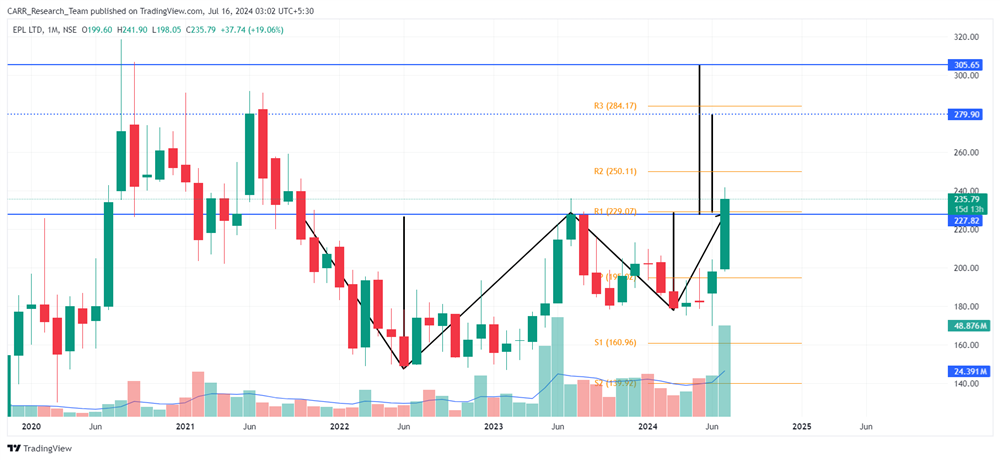

Stock name: EPL Ltd.

Pattern: Double bottom pattern

Time frame: Monthly

Observation:

The stock experienced a downward movement starting in August 2020 and later formed a double bottom pattern on its monthly chart. In July 2021, it saw a rapid upward movement and is now above the breakout line, although the breakout isn't confirmed until the candle completes. The stock has shown a bullish indicator on its MACD chart with high trading volume, and its RSI level is in a good zone. According to technical analysis, if the stock maintains its current momentum, it may continue to move upwards.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

Stock name: Blue Dart Express Ltd.

Pattern: Triple bottom pattern

Time frame: Weekly

Observation:

The stock experienced a downward movement from October 2022 and later formed a triple bottom pattern on its weekly chart. It broke out from this pattern in June 2024 with above-average trading volume and has since moved continuously upward. However, the RSI is now in the overbought zone, indicating a possible retest. According to technical analysis, if the stock maintains its current momentum, it may continue to rise further.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

News for the day:

- Adani Group expects its ports business to double in volume within five years, driven by strong growth in India's export and import demand. The ports segment saw revenue increase to Rs 20,972 crore in FY24 from Rs 17,304 crore the previous year. Karan Adani, managing director of Adani Ports and SEZ, noted that the logistics segment also grew, but at a slower pace. The company aims to handle 1 billion tonnes of cargo by 2030, with 90% from Indian ports and 10% from international operations. Adani Ports plans for organic growth at existing ports and will consider acquisitions and PPP projects for expansion.

- Varun Beverages Ltd (VBL), PepsiCo's bottling franchise partner, plans to invest $7 million to establish manufacturing units in Zimbabwe and Zambia. These units will produce, distribute, and sell Simba Munchiez snacks in the respective territories. VBL's subsidiaries, VFZ Varun Foods (Zimbabwe) and Varun Beverages (Zambia), will handle the operations. The investment aims to create an annual capacity of 5,000 MT for manufacturing Simba Munchiez at each location.

- Ashok Leyland has secured a Rs 981.45 crore order from Maharashtra State Road Transport Corporation (MSRTC) for 2,104 Viking buses, compliant with BSVI OBD II standards. The order will be fulfilled between August 2024 and August 2025, further strengthening Ashok Leyland's market position. This deal makes Ashok Leyland the dominant bus supplier in MSRTC's fleet of over 15,000 buses. Shenu Agarwal, Managing Director & CEO, highlighted the company's commitment to efficient and advanced public transportation solutions.