Stock name: Data Patterns (India) Ltd.

Pattern: Support breakout

Time frame: Daily

Observation:

The stock has seen a sharp decline in September 2023. Later, the stock consolidated and maintained a parallel channel from October 2023 to February 2024. However, on February 13, 2024, the stock broke below the channel support, backed by average trading volume and a recent bearish signal from the MACD indicator. Additionally, the RSI levels of the stock are at a low point. According to technical analysis, if the current downward momentum persists, the stock may see further decline.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

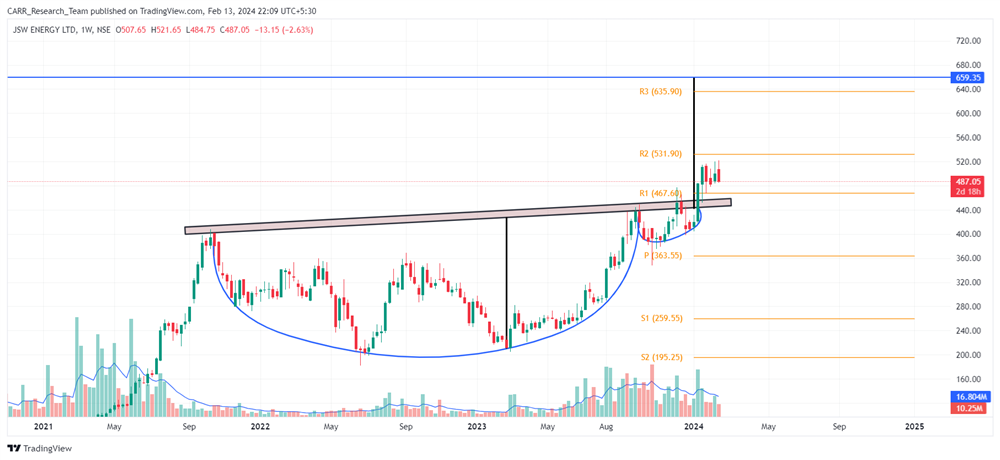

Stock name: JSW Energy Ltd.

Pattern: Cup and handle pattern

Time frame: Weekly

Observation:

The stock exhibited substantial upward movement in 2021, but from October 2021 to January 2024, it underwent consolidation, forming a cup and handle pattern on the weekly chart. January 2024 saw a breakout supported by significant trading volume and a bullish MACD signal. Post-breakout, the stock continued its upward trend. The RSI levels of the stock is also in a good position. Technical analysis indicates that if the current momentum is maintained, the stock may experience further upward movement.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

News for the day:

- The Indian Ministry of Defence has finalized a significant deal worth Rs 2,269 crore with Bharat Electronics Limited (BEL). The contract aims to enhance the country's defence capabilities and involves the procurement of cutting-edge defence equipment and systems from BEL. This move reflects the government's commitment to strengthening the defence infrastructure and supporting indigenous defence manufacturing. The agreement is expected to contribute to India's self-reliance in defence technology and bolster its strategic preparedness.

- Tata Motors has partnered with the Leadership Group for Industry Transition (LeadIT) to accelerate the transition to net-zero emissions, leveraging global best practices and influencing policy-making. The collaboration aligns with Tata Motors' commitment to achieving net-zero emissions in its Passenger Vehicles by 2040 and Commercial Vehicles by 2045.

- Sterlite Power has secured funding of Rs 2,400 crore from Rural Electrification Corporation Limited (RECLTD), a government-owned entity, for its Beawar project. This substantial financial support is expected to bolster Sterlite Power's efforts in enhancing power infrastructure and furthering electricity access in the region.