Stock name: Bombay Burmah Trading Corporation Ltd.

Pattern: Cup and handle pattern

Time frame: Weekly

Observation:

Between August 2020 and December 2023, the stock developed a cup and handle pattern on its weekly chart. Towards the end of December 2023, a breakout occurred, accompanied by trading volume exceeding the average, and a positive signal from the MACD indicator. Subsequently, the stock demonstrated an upward trajectory. Technical analysis suggests that should the stock sustain its present momentum, it may continue further upward movement.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

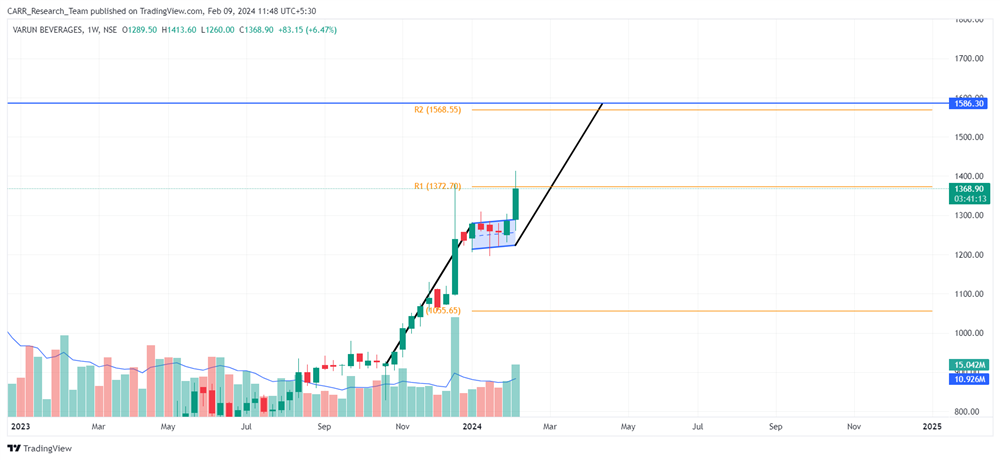

Stock name: Varun Beverages Ltd.

Pattern: Flag and pole pattern

Time frame: Weekly

Observation:

The overall trend of the stock has remained in the upward direction. The stock witnessed a swift ascent between October and December 2023. January 2024 saw a stabilization phase, resulting in the formation of a flag and pole pattern on the weekly chart. In February 2024, the stock broke out from this pattern, backed by trading volume above the average. Technical analysis suggests that if the stock sustains its current momentum, further upward movement may be anticipated.

You may add this to your watch list to understand further price action.

Disclaimer: This analysis is purely for educational purpose and does not contain any recommendation. Please consult your financial advisor before taking any financial decision.

News for the day:

- Nestle is planning to invest Rs 6,000-6,500 crore to expand its manufacturing operations in India's FMCG sector. The substantial investment aims to boost production capabilities and cater to the growing demand for Nestle products. This move reflects Nestle's commitment to strengthening its position in the Indian consumer goods market.

- Adani Power has secured the winning bid for Lanco Amarkantak at Rs 4,101 crore. This successful acquisition underscores Adani Power's strategic expansion in the power sector. The deal aligns with the company's efforts to enhance its presence and capacity in the energy industry. Adani Power's bid victory positions it for increased influence and growth within the power segment in India.

- Max Healthcare has successfully acquired Nagpur-based Alexis Hospital for Rs 412 crore. This strategic acquisition expands Max Healthcare's footprint in the healthcare sector, emphasizing its commitment to growth and service expansion. The move aims to strengthen Max Healthcare's presence in the medical landscape, aligning with its broader strategy of providing quality healthcare services.

Varun Beverages break out in volume date is 20 Dec 2023 and your analysis date is February 2024 is it I'M WRONG AUR RIGHT please reply