Introduction

Axis Bluechip fund is the flagship fund of the AMC with an Asset Under Management (AUM) of more than Rs. 33,000 Cr. as of January 2023, this is a huge AUM. The highest AUM was in August 2022 of Rs. 36,979.68 Cr. The AUM has grown multifold between 2017 to 2020 because of its fantastic returns during these years. To give you an idea about the growth of the fund, you must know that the AUM of the fund in Jan 2017 was Rs. 1,942 Cr only. Wow! If this is the growth in AUM, let us check how the returns were.

Returns

1) Calendar Returns

Source: Value Research

In the above image, you can see that the fund has given amazing returns in 2014 and from 2017 to 2020. In 2021, the fund fell short to perform with the benchmark and the category. 2022 was not good as the benchmark and category both gave positive returns while the fund gave negative returns. This is where it started hurting the investors.

2) Trailing Returns

Source: Value Research

In the short term, the fund is bleeding. But, by now we all are aware that you should invest in large-cap funds with an investment horizon of more than 5 years. So, if we look at long-term returns, it is 12.14%, 15.30%, and 14.64% for 5 years, 7 years, and 10 years respectively which is a fair enough performance.

Risk Return Parameters

Similarly, if we look at the risk-returns parameters –

Source: Value Research

Mean returns should be higher the better, you can see that the fund is lagging in the category where it is ranked second from below. A silver lining can be seen in the form of standard deviation and beta where the fund manager has managed to keep a check on volatility. But the problem lies in Sharpe ratio and Alpha. The Sharpe ratio is low, and Alpha is negative. Those who have taken the course on the Magic of Mutual funds know in detail what these ratios mean, and how important they are in analyzing a fund. If you have still not enrolled in the course, you can click on the image below –

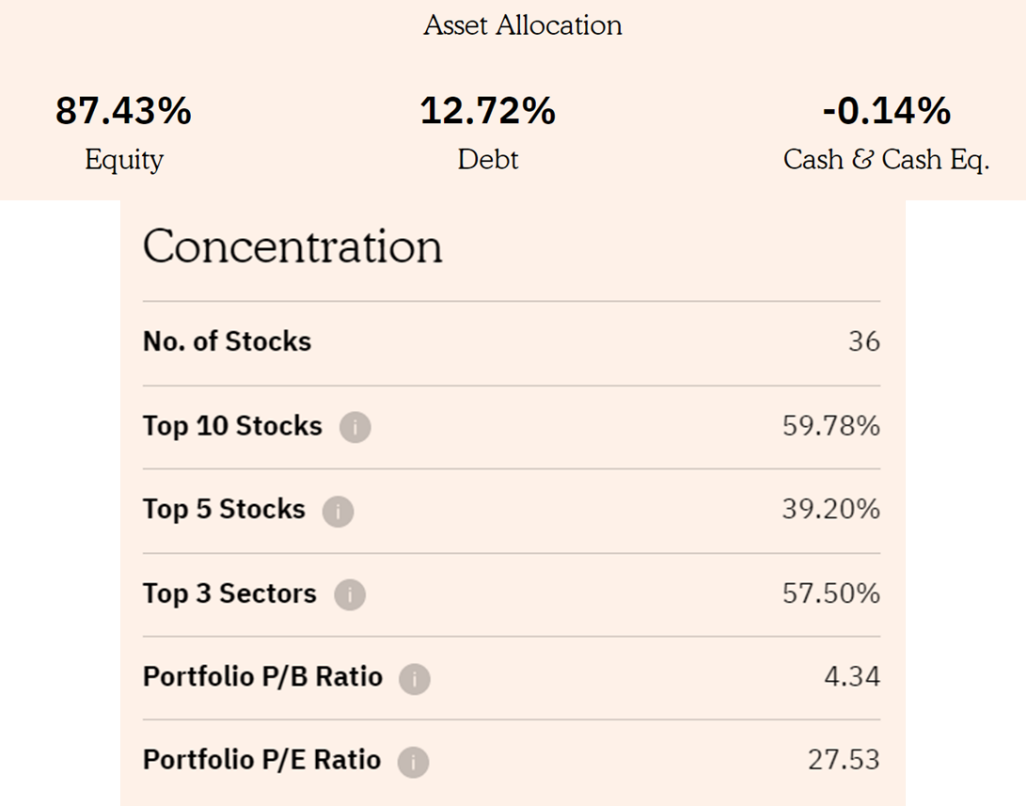

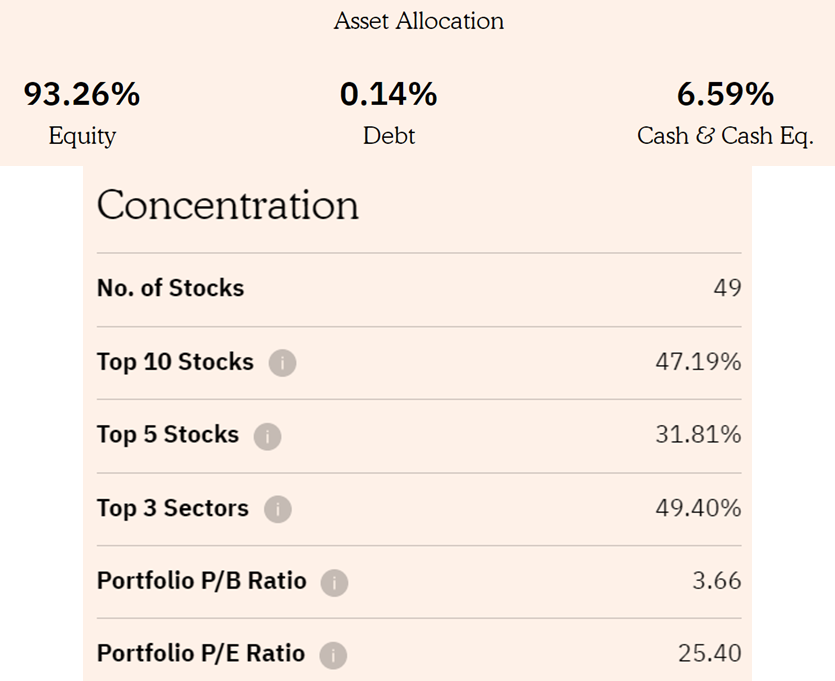

Portfolio Concentration

Now, let us dig deeper and try to understand what caused the problem. For that, we will have to compare the portfolio concentration of Axis bluechip fund with one of its peers. I think this peer can be the SBI Bluechip fund considering that it is the best-performing fund in the peers having an AUM of more than Rs. 30,000 Cr.

1) Axis Bluechip Fund -

2) SBI Bluechip Fund –

Source: Value Research

If we look at the above data, we can see that Axis Bluechip fund has 87% in equity whereas SBI Bluechip has a 93% allocation to equity. So, SBI is in a better position to generate additional returns. The allocation to the top 5 stocks is more in Axis Bluechip funds, this creates pressure on the fund manager that these 5 stocks will decide the fate of the fund. So, now it becomes necessary to see which are these 5 stocks.

Top stocks in the Portfolio

1) Axis Mutual Fund –

2) SBI Bluechip Fund –

Source: AMC website

I think there is no need for any explanation here. In the portfolio of Axis Bluechip fund, 3 out of the top 5 stocks have generated a negative return, while the score for SBI Bluechip fund is only 1 out of the top 5. Another stock that attracts attention in SBI bluechip fund which is missing from the Axis Bluechip fund is ITC Ltd. I hope the reason for underperformance is slowly getting clear now.

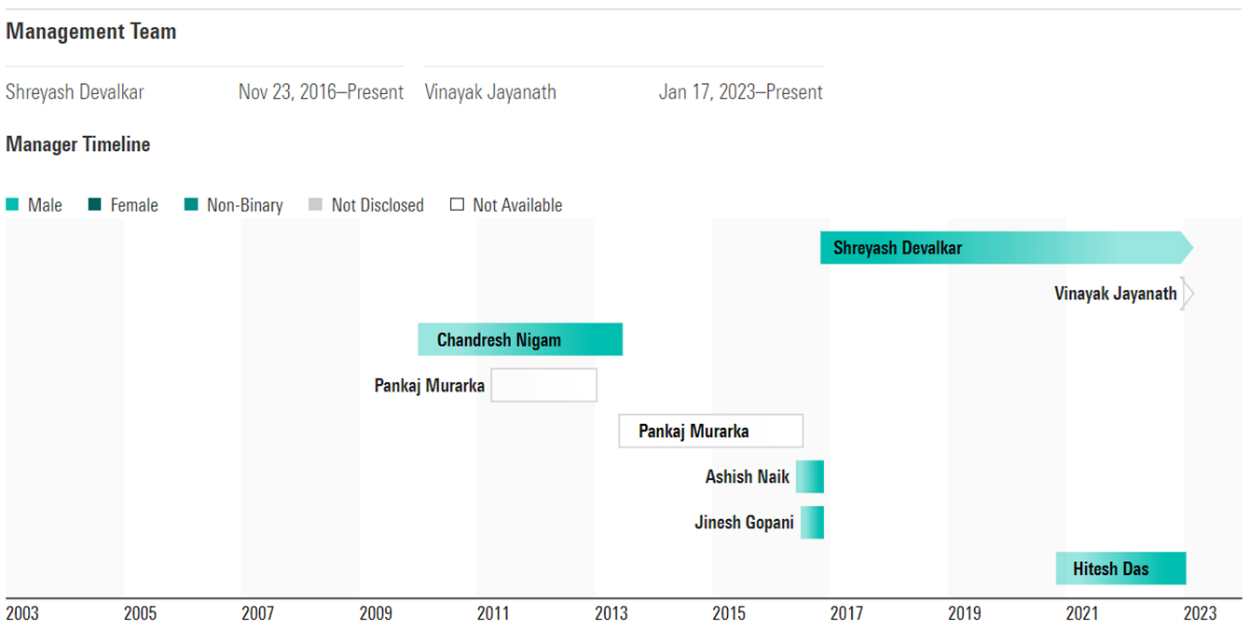

Fund Manager History

Usually, when there is a change in fund management, we have seen that the new fund manager takes his time to implement the strategies, which causes the fund to underperform for a brief period of time. Let us see if it is the case with Axis Bluechip Fund –

Source: Morningstar

In this chart, you can see that Shreyas Devalkar has been with the fund house since 2017. It is he who had delivered the golden returns of this fund. So, we cannot say that the underperformance is because of the change in fund management.

Will I redeem my investments in this fund?

We all know that the stock market moves in cycles and there are ups and downs. Axis blue chip fund has witnessed a positive cycle from 2017 to 2020 now it is time for the negative cycle. You cannot expect a fund manager to keep generating amazing performances every single year. It is not like the fund manager is selecting stocks that are not good. His stock picks are simply going through a rough phase. Maybe now he will relate to our merchandise which says “I Buy… Asa Kasa Kay?” :D. Jokes apart I think it is only a matter of time until the fund reverses to its glory days. All we need to do is be patient.

This was all and only about the Axis Bluechip fund, but there is more to this analysis. The lead trader/dealer of Axis Mutual Fund who was also one of the fund managers was recently barred by SEBI in a front-running case linked to the fund house. To know more about the front-running scandal and if this scandal changes my view about investment in this fund don’t forget to watch the video on my YouTube channel. Until then!