Since the COVID-19 pandemic and global meltdown in stock markets, the whole Indian banking sector has underperformed due to fear of NPA. Even, RBI mandated banks to make COVID-19 related provisions in their books and instructed them to not declare any dividend till the end of September month. Before investing in banks, investors need to watch out for some of the key ratios, we have taken the top 5 banks as our examples based on market capitalization. Below are some of the important parameters to watch out for:

1. On the basis of Liquidity of Banks - Capital Adequacy Ratio:

Capital Adequacy Ratio (CAR) is simply the core capital of the bank. CAR is measured based on Tier-1 capital and Tier 2 capital. Tier 1 capital is such a capital where a bank can absorb the losses without disturbing normal business operations. Thus, it provides a liquidity cushion to the bank and it also protects the depositors. Tier 2 capital is such a capital where the bank can absorb the losses in the event of bankruptcy of a bank, it provides lesser protection to the depositors. Banks are required to maintain a minimum CAR of 10.5% including a Capital Conservation Buffer of 2.5% as per Basel III norms.

2. On the basis of Asset Quality:

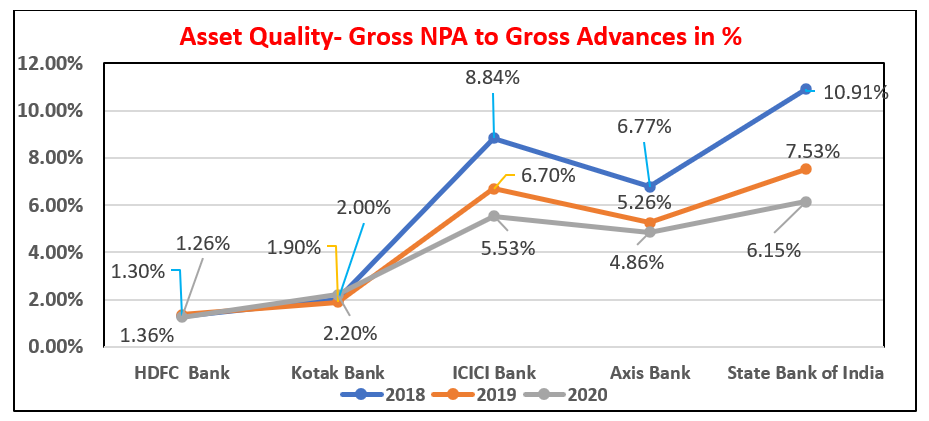

Bank’s asset quality matter’s the most, higher the NPA ratio, the worst the case, NPA’s ultimately wipe out the capital of the bank, thus impacting the CAR ratio.NPA means the default of interest and the principal amount by the borrower. As per RBI, banks classify a borrower’s account as NPA when the interest due on the loan is not paid within 90 days. Investors need to analyze both Gross and Net NPA ratios Gross Non-Performing Assets as a % of Gross Advances (GNPA): GNPA is the sum of all the types of unpaid loans by the borrowers.Net Non-Performing Assets as a % of Net Advances (NNPA): NNPA is the sum of unpaid loans less the provision made for these bad loans.

3. On the basis of Profitability:

One of the key profitability ratios to watch out for is Net interest Margin- NIM. Since the bank’s business model is to raise funds from depositors and lend it to individuals and businesses, it receives interest on an amount lent and pays interest on the funds raised via various routes. Thus, the difference between interest earned and interest expended over its average earning assets is called net interest earned, it is popularly expressed in % form and is popularly known as NIM.