We all have observed “the new normal” during this pandemic. Hand sanitisers have now become one of the irreplaceable items in our bags. Why is that? Because these sanitisers can effectively kill germs and viruses and reduce our chances of getting infected. This practice has become so essential during the current times that there are various kinds of sanitisers being offered in the market. From alcohol-based, alcohol-free, spray, gel-based to fragrant sanitisers, there are numerous options available for us.

Do you think that if we have so many types just for a sanitiser, there won’t be any in derivatives? Of course, we do! And that’s exactly what we will be discussing in today's blog. Before we dig in, if you wish to revise the basics of derivatives discussed in the previous blog, click here.Now let’s get started!What is the structure of the Derivatives market?

Before jumping into the types of derivatives, we must understand the structure of the derivatives market. We already know that a derivative is a contract, based on the value of an underlying asset like stocks, bonds, commodities, currencies, interest rates and even indices.Coming to the markets’ structure, the derivatives market is broadly classified into two categories:

a. OTC derivatives market

In simple words, the OTC market is where derivative instruments are traded informally. An over-the-counter (OTC) derivative is a contract that is tailored as per the needs of the parties involved. These instruments are not listed on any exchange and hence are negotiable between a buyer and a seller to match their risk and return. It is a decentralized dealer market. No intermediaries or exchanges like NSE, BSE, MCX, etc. are involved in the transaction due to which these instruments possess counter-party risk. Popularly known OTC derivatives instruments include forwards and swaps which we shall discuss ahead in this blog.

b. Exchange-traded derivatives market

As the name suggests, these derivatives instruments can be traded on exchanges like NSE, BSE, MCX, etc. These instruments are standardized contracts that have a pre-determined expiration date, price, lot size, etc. and hence are non-negotiable. Here, the exchanges act as an intermediary and thereby eliminates counter-party risk. Unlike the OTC derivatives market, this market is regulated by SEBI. Popularly known exchange-traded derivatives instruments include futures and options which we shall discuss ahead in this blog.

What is the difference between OTC & Exchange-traded derivatives markets?

What are the types of derivatives?

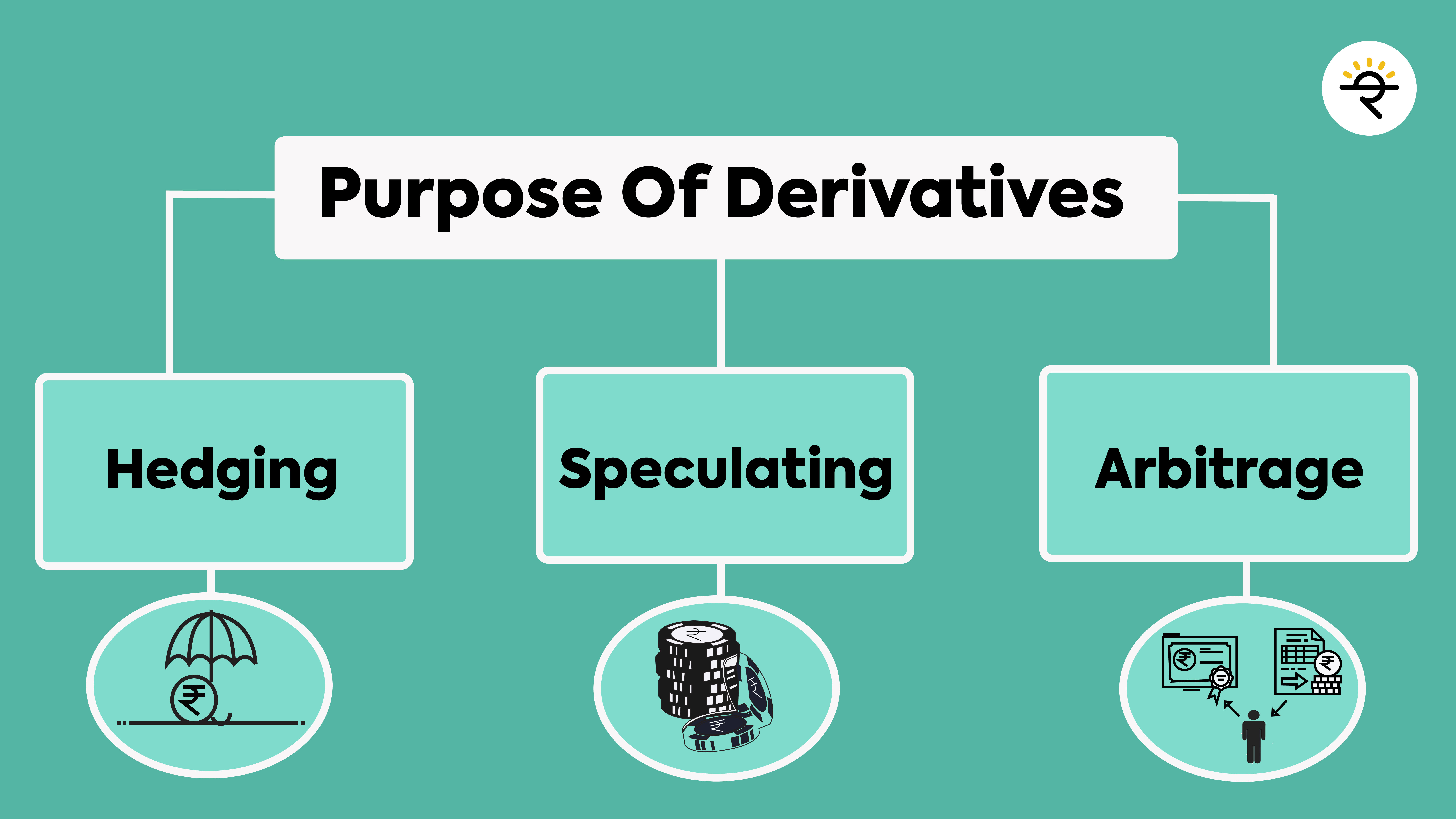

The primary purpose of derivatives is to minimize your risk and earn profits. But how to do that? For that, we have different types of derivatives being traded, in both OTC and exchange-traded markets. So, let’s unfold them one by one.

1. Forwards

Forwards are customized contracts between a buyer and a seller based on an underlying asset at a pre-decided price, quantity, expiration date, etc. I am sure after reading the word customized, you must have guessed that forwards are OTC instruments. You are absolutely right! Hence, forwards being a private transaction, do not trade on exchanges. Investors and businesses use forwards to hedge against the volatility in pricing.

2. Swaps

To put it very simply for you, swaps enable the buyer and the seller to exchange their revenue streams based on an underlying asset. These are again OTC instruments so no exchanges are involved in the transaction. Investors and businesses use swaps to hedge and speculate against the volatility in pricing. The most common types of swaps are interest rate swaps and currency swaps.

3. Futures

Now, the real game starts with Futures and options. Futures are standardized contracts between a buyer and a seller based on an underlying asset at a pre-decided price for a later date. We can say that futures are an advanced version of forwards. They are highly tradable due to the involvement of the exchanges. This also removes the counterparty risk on the traders’ part. Investors and businesses use future contracts to hedge and speculate against the volatility in pricing. The most common types of futures involve stock futures, index futures, currency futures and commodity futures.

As the name suggests, options are contracts that give the buyer a right but not the obligation to buy or sell the underlying asset at a pre-decided price. The buyer of the option has to pay a premium to the seller. You must have heard about the call and put options that are widely known amongst traders. These are commonly used to hedge and speculate against portfolio risk.

Bottom Line

Well, the derivatives market is huge and there’s a lot more to learn about all the types of derivatives we discussed today. But don’t worry, we shall understand their basics better in future blogs. It is important to note that even though there’s huge profit potential in derivatives there’s an equal or more probability of losing. It is important to have extremely good knowledge about the stock market , technical analysis and derivatives, to trade in the derivatives market. If you want to learn about Futures and options in the most fun, simplified and practical manner, make sure you check out my course here. I am sure you will love it. Until next time!