Product Portfolio

Let’s have a look at the product portfolio of the company.

I hope that cables and house wires need no further explanation. Coming to Winding wires, these wires are used for winding submersible pump motors of all sizes. They are used for both Domestic & Industrial applications. Stainless Steel Wires are used in Engineering, Chemical, Construction, and many other industries besides the various type of applications in the manufacturing of kitchenwares, ornaments, utensils. Talking about EPC, the company has forward integrated into Engineering, Procurement and Construction (EPC) services for utility projects having significant cabling requirements. They offer end-to-end turnkey solutions including engineering, consultancy, and project management for Extra high voltage substations, transmission lines, underground cabling, overhead lines, etc. These services are being delivered across core sectors like power, renewables, railways, refineries, petrochemicals, cement, steel among others.

Business Segments

Have a look at the company’s business segmentation and its revenue contributions.

If you observe well under revenue by product segments, revenue for cables and turnkey projects have gone down. Why is that? While reading the conference call transcripts, I found out that the company is reducing its stake in the EPC business due to the elongated working capital cycle, slow recovery of payments, and low margin profile. Due to this, they will limit its contribution to overall sales at 10-15%. This is a strategic decision where they plan to redirect the freed-up resources to the retail segment with an aim to generate 40-50% of overall sales from this segment in the medium term.

Industry Analysis1. Global W&C IndustryThe global wires and cables market size was estimated at USD 183.14 billion in 2020, as per a report published by Grand View Research. It is expected to expand at a CAGR of 4.4% over 2021-28, to reach USD 260.16 billion by the end of 2028. This growth is attributable to the increasing use of cables and wires across the world for transmission and distribution of power, for incremental application in the telecom sector and data centers. Increasing urbanization and commercialization are expected to further bolster investments in the real estate industry, thereby, driving the demand for low voltage insulated wires and cables.

2. Indian W&C Industry

The Indian cables and wires market is projected to grow at a CAGR of 4% between 2021 and 2025, to reach USD 1.65 billion in 2025. Out of a total capital expenditure planned by the government, segments such as energy, roads and highways, urban infrastructure, and railways cumulatively account for ~71% of the total investments, with the energy sector commanding the highest share at 24%. This underscores substantial and sustainable demand for the C&W industry in the coming years.

About the company

KEI Industries Ltd was established in 1968 as a partnership firm under the name Krishna Electrical Industries. Their products are sold in 50+ countries with offices in 5 countries. They enjoy a 7% market share in India’s organized W&C industry and 12% in the institutional segment. They have a network of 1,655 distribution partners across India. The company was able to backwards integrate services by setting up in-house manufacturing of PVC. They continued to be co-sponsors of IPL for the fifth year. KEI was the principal partner to the Rajasthan Royals Team.

1. CAPEX Plans

As stated by the management in the investor’s conference call, the company will continue to invest in increasing the capacity. In the previous years, they had increased housing wires capacity with the setting of a new facility. They are now looking at investing around Rs. 600-700 Crore from internal accruals for growing their capacities for LT, HT, and EHV cables to maintain a CAGR of 17% to 18% against a CAGR of 15% achieved during the last 15 years. The CAPEX will be undertaken over five years. Meanwhile, the company has sufficient capacity to cater to the market demand over the next years by when new production lines will also be available.

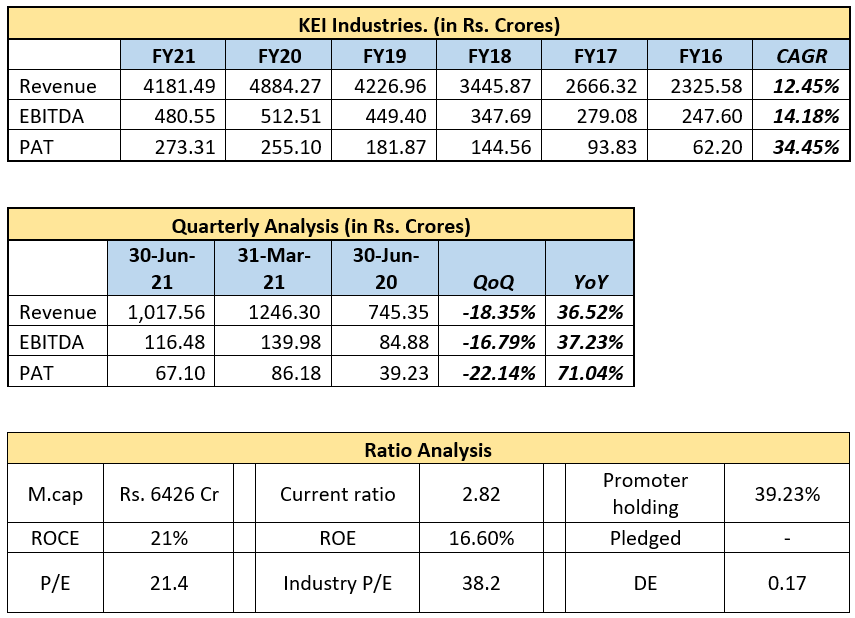

Financial Analysis

The 5-year CAGR for Revenue, EBITDA, and PAT are well above average. If we look at quarterly numbers for the same parameters, we can see degrowth on a QoQ basis but YoY growth looks good. The QoQ degrowth happened due to the non-clearance of some orders of EHV cables and the second lockdown in this quarter however, the management is confident that the order will be reflected in Q2.

Apart from this, the company has good ROE and ROCE with low DE. The Current ratio looks good as well. There is no pledging of shares. Currently, the stock appears undervalued when compared to industry P/E.

Technical Analysis

The stock has been in an uptrend. Recently, an ascending triangle was observed, however, the price has been consolidating after it gave a breakout. As per Pivot levels, the next resistance is around 788.64 and 810.20 and support is around 714.80 and 694.70. RSI has been stable at around 60. MACD is bullish but the histogram is showing weakening bullishness due to the recent consolidation.

I hope you enjoyed learning about this company and it added value to your knowledge basket. If you haven’t watched the video on the other 2 interesting yet pocket-friendly stocks which I discussed on my YouTube channel today, click on the image below. Make sure to drop your views in the comments section if you would love more of such videos and blogs. Until next time!